Topic 5:

Strategic Alternatives - Mergers and Acquisitions (M&A) and International

Chapter 7: Mergers and Acquisitions - An Introduction

7.1 Overview

Mergers and acquisitions (M&A) are strategic decisions made by companies to consolidate or expand their business operations. These transactions can significantly impact a company's market position, financial performance, and overall strategy. This chapter will explore the fundamental concepts of M&A, the differences between mergers and acquisitions, and the various formulations involved in these transactions.

7.2 Mergers vs. Acquisitions

- Mergers: A merger occurs when two or more companies combine to form a single entity. The merging companies cease to exist as separate entities, and their assets and liabilities are consolidated into the new company. Mergers are typically seen as a partnership between equals and are often pursued to achieve synergies, expand market reach, or diversify product offerings.

- Acquisitions: An acquisition involves one company (the acquirer) purchasing another company (the target). The target company becomes a part of the acquirer, either as a subsidiary or by being fully integrated into the acquirer's operations. Acquisitions are often used to gain access to new markets, technologies, or resources.

7.3 Types of M&A Transactions

Equity vs. Nonequity:

- Equity Transactions: In these deals, the acquirer purchases the equity (shares) of the target company. This can be done through a stock purchase agreement or a stock-for-stock transaction, where the acquirer offers its own shares in exchange for the target's shares.

- Nonequity Transactions: Also known as asset acquisitions, these deals involve the acquirer purchasing specific assets (e.g., property, equipment) or liabilities of the target company. This allows the acquirer to select only the parts of the target that align with its strategic goals.

Horizontal vs. Vertical vs. Conglomerate:

- Horizontal M&A: This occurs when companies in the same industry merge or one acquires another. The goal is often to achieve economies of scale, increase market share, or reduce competition.

- Vertical M&A: This involves companies at different stages of the same supply chain. For example, a manufacturer might acquire a supplier (backward integration) or a distributor (forward integration).

- Conglomerate M&A: This occurs when companies from unrelated industries merge or one acquires another. The goal is often diversification of risk or expansion into new markets.

Friendly vs. Hostile:

- Friendly M&A: In these transactions, the management of both companies agree to the deal and work together to ensure a smooth transition.

- Hostile M&A: In these deals, the acquirer pursues the target company against the wishes of the target's management. This often involves making a direct offer to the target's shareholders.

7.4 Conclusion

Mergers and acquisitions are complex transactions that can reshape the competitive landscape and create new opportunities for growth. Understanding the different types of M&A and the strategic motivations behind them is crucial for business leaders and investors. In the following chapters, you will delve deeper into the M&A process, the challenges involved, and the keys to successful integration.

MEGA Moment

You will likely have the opportunity to expand your operations internationally during this decision period. If your course is not running the version of the simulation that includes a merger, you have only one or two more decision periods to earn market share and improve your competitive position. Be sure to engage with your Instructor, who is able to help your team identify areas for improvement relative to your competitors. NOTE: Your instructor, like you, does not know the decisions required to win. Every simulation universe is unique, and the results derive from the cumulative decisions of each of the teams in that universe.

If you are playing the simulation version that includes the merger, please be sure to read the additional materials associated with the rules, standards, assumptions, and accommodations built into the simulation model. There are some new rules you must know.

The MEGA simulation essentially creates a hybrid "merger" that admittedly may not represent something you would typically see in the real world. In order to offer this feature, many real-word complexities have either been simplified or automated so the creators could capture some of the important learning opportunities.

The merger creates a new market opportunity in a new region. Region 2 has somewhat different dynamics than Region 1. Be sure to read and understand all of the MEGA documentation as this MEGA Moment is not intended to be in any way comprehensive. The purpose here is to briefly describe how the learning content might relate to the simulation you are playing.

M&A activity and international strategic concepts presented in this class provide a basic outline and some of the reasons companies chose to merge or expand internationally. M&A activity is a very common strategic move in business. Large corporations are involved in M&A activities virtually all the time. Midsize and small companies often operationalize their strategies through M&A activities. As it relates to the MEGA simulation, you should carefully consider how the merger opportunities offered could improve your financial performance relative to your peers and make informed decisions.

It is quite true that properly aligned teams may find significant opportunities, and success, in Region 2. It is also true that this merger may not result in favorable outcomes. As common as M&A activity is, in the real world the odds that any merger achieves its prospective impact are slim. M&A activity is complicated and risky.

Key Terms

- Mergers and Acquisitions (M&A)

- Mergers

- Acquisitions

- Equity Transactions

- Nonequity Transactions

- Horizontal M&A

- Vertical M&A

- Conglomerate M&A

- Friendly M&A

- Hostile M&A

Chapter 8: International Business Strategy - An Introduction

8.1 Introduction

International business strategy involves the actions and decisions that companies take to compete in global markets. As companies expand beyond their domestic borders, they face new challenges and opportunities that require a different strategic approach. This chapter will explore the motivations for international expansion, the risks involved, the modes of entry, and the organizational and financial implications of operating in multiple countries.

8.2 Reasons for International Expansion

Companies may pursue international expansion for several reasons:

- Market Access: Expanding internationally allows companies to access new markets, increase sales, and diversify their customer base.

- Cost Reduction: Companies may seek lower production costs by moving operations to countries with cheaper labor, raw materials, or favorable tax regimes.

- Competitive Advantage: International expansion can provide access to unique resources, technologies, or knowledge that can enhance a company's competitive advantage.

- Risk Diversification: Operating in multiple countries can help companies spread risk and reduce dependence on a single market.

8.3 Risks of International Expansion

International expansion comes with several risks, both internal and external:

- Cultural Differences: Companies may struggle to understand and adapt to different cultural norms, consumer preferences, and business practices.

- Political and Legal Risks: Companies may face political instability, regulatory changes, or legal disputes in foreign countries.

- Economic Risks: Fluctuations in exchange rates, inflation, or economic growth can impact a company's financial performance.

- Operational Risks: Managing operations across multiple countries can be complex and challenging, with increased coordination and communication requirements.

8.4 Modes of Entry

There are several traditional modes of entry into international markets:

- Exporting: Selling domestic products in foreign markets. Example: A U.S. winery exporting its wines to Europe.

- Licensing: Granting a foreign company the right to use intellectual property in exchange for royalties. Example: A fashion brand licensing its logo to a foreign manufacturer.

- Franchising: Allowing a foreign company to operate a business under the franchisor's brand and business model. Example: McDonald's opening franchises in various countries.

- Joint Ventures: Partnering with a local company to share resources and risks. Example: A U.S. car manufacturer forming a joint venture with a Chinese company to produce cars in China.

- Foreign Direct Investment (FDI): Establishing or acquiring operations in a foreign country. Example: A tech company opening a research and development center in India.

8.5 Organizational and Structural Challenges

International expansion can pose organizational and structural challenges:

- Coordination: Managing operations across multiple countries requires effective coordination and communication between headquarters and local subsidiaries.

- Adaptation: Companies may need to adapt their products, marketing strategies, or organizational structures to suit local conditions.

- Talent Management: Attracting, retaining, and managing talent in different countries can be challenging due to cultural, legal, and economic differences.

8.6 Financial Implications

International expansion can impact financial operations:

- Regulatory Compliance: Companies must comply with local financial regulations, including tax laws, accounting standards, and reporting requirements.

- Risk Management: Corporate treasuries must manage risks such as exchange rate fluctuations, political instability, or credit risks.

- Financial Complexity: Managing finances across multiple countries can be complex, requiring sophisticated financial systems and expertise.

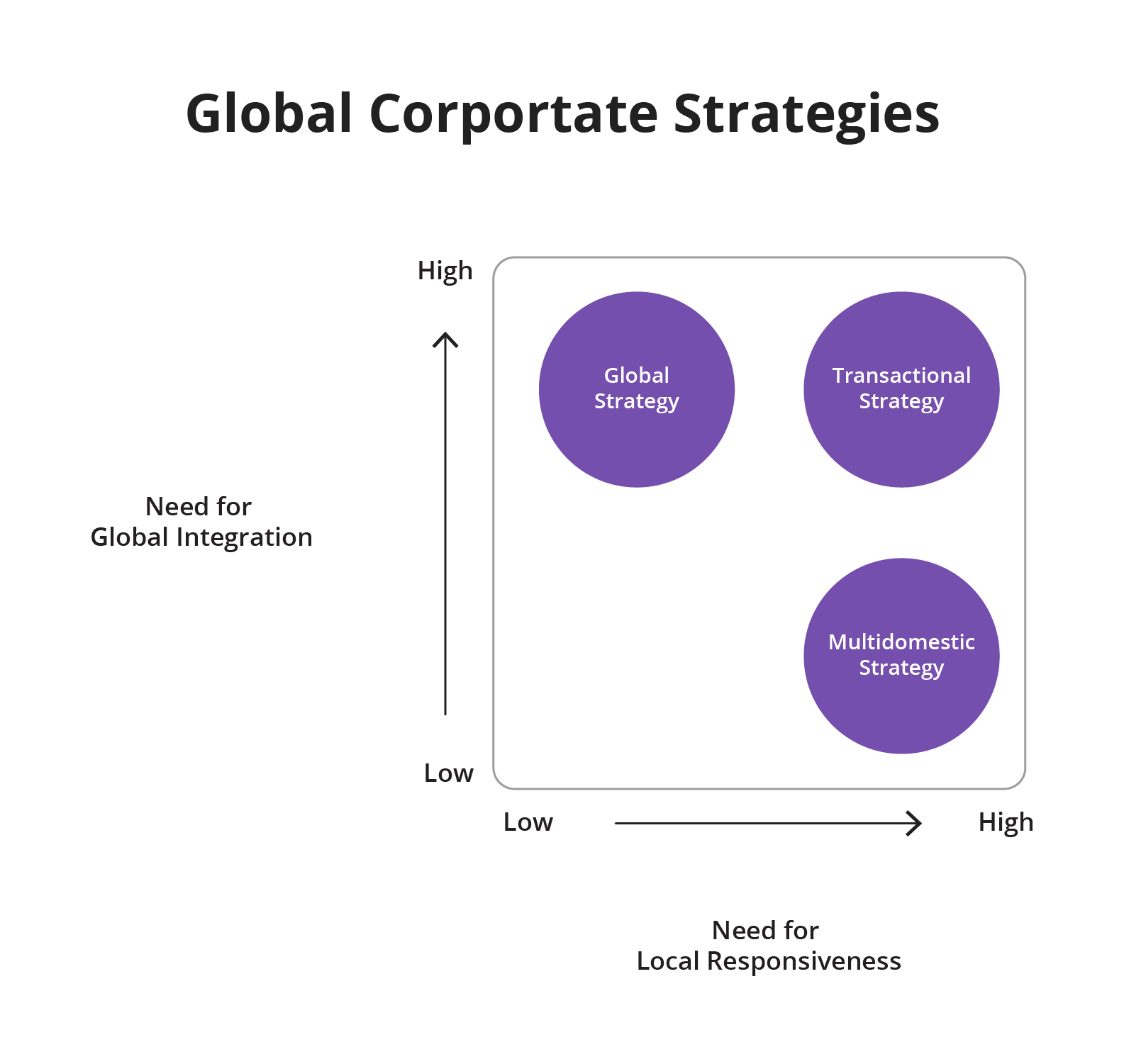

8.7 Global, Transnational, and Multidomestic Organizations

Definitions and Differences

- Global Organizations: These companies have a centralized management structure and a uniform strategy for all markets. They view the world as a single market and aim to create standardized products and services that appeal to customers worldwide. Global organizations benefit from economies of scale and a consistent brand image. Example: Coca-Cola uses a global strategy by selling the same product with similar marketing campaigns worldwide.

- Transnational Organizations: These companies combine elements of global and multidomestic strategies. They have a decentralized management structure and adapt their products and services to local markets while maintaining global integration. Transnational organizations benefit from both economies of scale and local responsiveness. Example: McDonald's is a transnational company that offers a standardized menu worldwide but also adapts its offerings to local tastes, such as the Teriyaki Burger in Japan or the McAloo Tikki in India.

- Multidomestic Organizations: These companies have a decentralized management structure and tailor their products and services to each local market. They operate independently in each country and focus on meeting the specific needs of local customers. Multidomestic organizations benefit from strong local responsiveness. Example: Nestlé is a multidomestic company that adapts its product portfolio to local preferences, such as Maggi noodles in India or Nescafé Dolce Gusto in Europe.

Choosing the Right Approach

The choice between global, transnational, and multidomestic strategies depends on several factors:

- Market Similarities/Differences: If markets have similar customer preferences and needs, a global strategy may be more appropriate. If markets have distinct preferences and needs, a multidomestic strategy may be more suitable.

- Economies of Scale: If achieving economies of scale is crucial, a global strategy may be more beneficial. Transnational organizations can also achieve economies of scale while adapting to local markets.

- Local Responsiveness: If local adaptation is essential, a multidomestic strategy may be more appropriate. Transnational organizations can also adapt to local markets while maintaining global integration.

- Competition: If global competitors dominate the market, a global strategy may be necessary. If local competitors are strong, a multidomestic strategy may be more beneficial.

- Regulatory Environment: If countries have strict regulations that require local adaptation, a multidomestic strategy may be more suitable.

Global, transnational, and multidomestic organizations have different approaches to international business strategy. The choice between these strategies depends on factors such as market similarities/differences, economies of scale, local responsiveness, competition, and the regulatory environment. Companies must carefully consider these factors to determine the most appropriate strategy for their international operations.

8.8 Conclusion

International business strategy involves a complex interplay of factors, including market access, risk management, organizational structure, and financial operations. Companies must carefully consider their motivations for international expansion, the risks involved, and the implications for their operations. This course and this strategy guide have only touched the surface of what is a very complex and dynamic aspect of business. If you have an interest in operating at this level, you are encouraged to continue your studies. Discuss your specific interests with your Instructor and ask for next-step guidance for content that will be of interest to you.

MEGA Moment

If you have decided to pursue any of the opportunities open to you via the merger, you should be seeing some initial results. Be sure to identify where and how your competition is approaching their engagement with Region 2. This will vary by team and by universe and the results will likewise vary widely.

This international section should help you understand some of the organizational demands resulting from international operations. Are you organized to exploit a global international strategy? If so, are you making decisions in the simulation to leverage the intended benefit of this strategy? Perhaps you believe the competition, market, and economy require a transnational structure. Have your decisions supported the characteristics of a strategy and transnational structure? The same could be considered for multidomestic.

There are limitations to MEGA relating to fully controlling these organizational structures. For example, the marketing effort is independent in each region. This would be more multidomestic. Whereas the engineering decisions are limited to a more global perspective. There are, however, some decisions within your control that would be directing funding and focus to one or the other. You also have the opportunity, as a simulation team, to organize yourselves in principal areas of responsibility that would also give directional influence to one of the three discussed structures.

Modes of entry, also discussed in this topic are, in fact, something you will have to decide as a MEGA team competing in the merger version. Are you exporting production or will you be investing in production in Region 2? These are fundamentally modes of entry decisions. It is anticipated that the simulation will be a dynamic learning experience that provides each student with the opportunity to understand how some basic textbook information gets applied in a realistic way and how access to data and a dynamic environment complicates something that on the surface seems quite simple.

Regardless of the specific format of the simulation you are playing, international business adds a layer of complexity to all business operations and an appreciation for the basic strategic aspects of those operations.

Key Terms

- Global Strategy

- Greenfield Venture

- International Diversification Strategy

- Multidomestic Strategy

- Transnational Strategy

Topic 5 Mini Cases

7.1 Mini Case Study: "TechTitan's Hostile Takeover of InnovateCorp"

Background: TechTitan, a global technology conglomerate, had been eyeing InnovateCorp, a smaller but highly innovative tech company, for some time. InnovateCorp had developed cutting-edge AI technology that TechTitan believed would complement its existing product portfolio and give it a competitive edge. However, InnovateCorp's management has repeatedly declined TechTitan's acquisition proposals, believing they could achieve greater success independently.

Identifying the Target: TechTitan identified InnovateCorp as a potential target for a hostile takeover based on several factors:

- Strategic Fit: InnovateCorp's AI technology aligned well with TechTitan's strategic goals and could enhance its product offerings.

- Financial Performance: InnovateCorp had strong financials, a robust R&D pipeline, and significant growth potential.

- Market Position: InnovateCorp's technology had the potential to disrupt the market and give TechTitan a competitive advantage.

Executing the Takeover

- Tender Offer: TechTitan launched a public tender offer to purchase InnovateCorp's shares at a premium above the current market price. This was a direct appeal to InnovateCorp's shareholders, bypassing its management.

- Proxy Fight: TechTitan initiated a proxy fight, urging InnovateCorp's shareholders to replace its current board of directors with a new slate that would approve the acquisition.

- Acquiring Shares: TechTitan started purchasing InnovateCorp's shares on the open market, aiming to acquire a controlling stake.

Defensive Measures by InnovateCorp: InnovateCorp's management, determined to fend off the hostile takeover, employed several defensive tactics:

- Poison Pill: InnovateCorp adopted a shareholder rights plan, commonly known as a "poison pill." This allowed existing shareholders to purchase additional shares at a discount if an acquirer bought a certain percentage of the company's stock, diluting the acquirer's ownership and making the takeover more expensive.

- White Knight: InnovateCorp sought a friendly acquirer, or "white knight," willing to make a counteroffer that would be more favorable to InnovateCorp's management and shareholders.

- Crown Jewel Defense: InnovateCorp considered selling its most valuable assets (the "crown jewels"), such as its AI technology, to make the company less attractive to TechTitan.

- Litigation: InnovateCorp filed a lawsuit against TechTitan, alleging unfair business practices and seeking to delay or prevent the takeover.

Conclusion: Hostile takeovers can be complex and contentious battles, with both the acquirer and target employing various tactics to achieve their goals. In this fictional case, TechTitan pursued a hostile takeover of InnovateCorp to gain access to its AI technology, while InnovateCorp's management used multiple defensive measures to resist the takeover. The outcome of such battles depends on factors such as shareholder sentiment, the effectiveness of defensive tactics, and the determination of both parties.