Topic 2:

The Competitive Environment: Scanning and Analysis

Chapter 2: Navigating the External Business Landscape

Introduction

Every business operates within a broader environment, influenced by societal trends, economic shifts, and global events. As a budding business leader, understanding this external landscape is paramount. This chapter will delve into the various external factors that shape business strategies. By mastering this content, you will be able to anticipate market changes, identify opportunities, and mitigate potential threats, making you an invaluable asset to any organization in a world where adaptability is key.

2-1. The Crucial Role of External Environment Analysis

Understanding the firm's external environment is paramount. It shapes potential opportunities and threats, influencing strategic decisions. By analyzing the external environment, firms can anticipate market shifts and adapt their strategies, ensuring resilience and competitiveness.

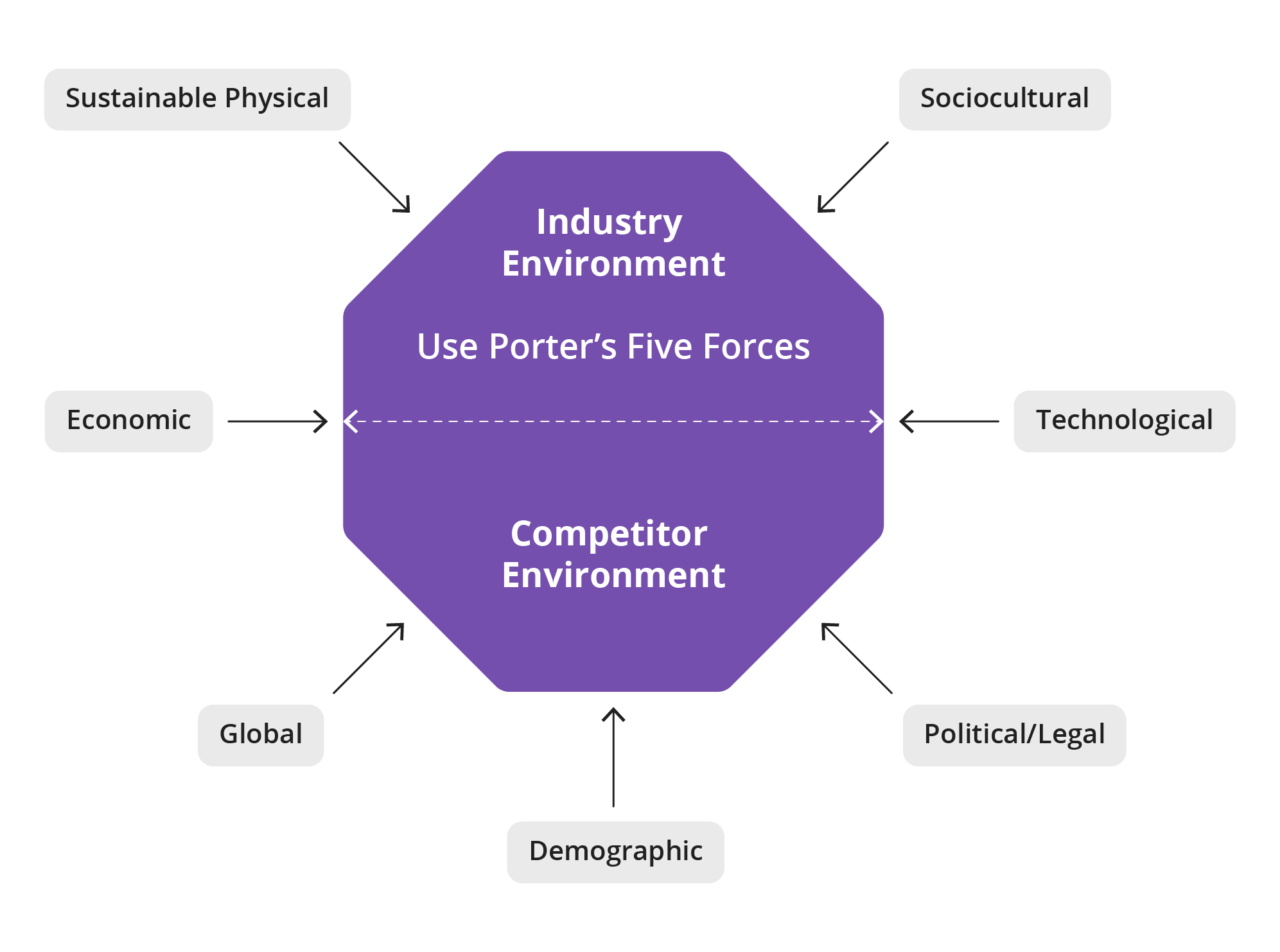

2-2. Delineating the General and Industry Environments

- General Environment: This encompasses the broader societal dimensions that can influence an industry and the firms within it. It is more indirect but sets the context for the industry environment.

- Industry Environment: This pertains to conditions inherent in a firm's specific industry. It has a more direct effect on a firm's strategic competitiveness.

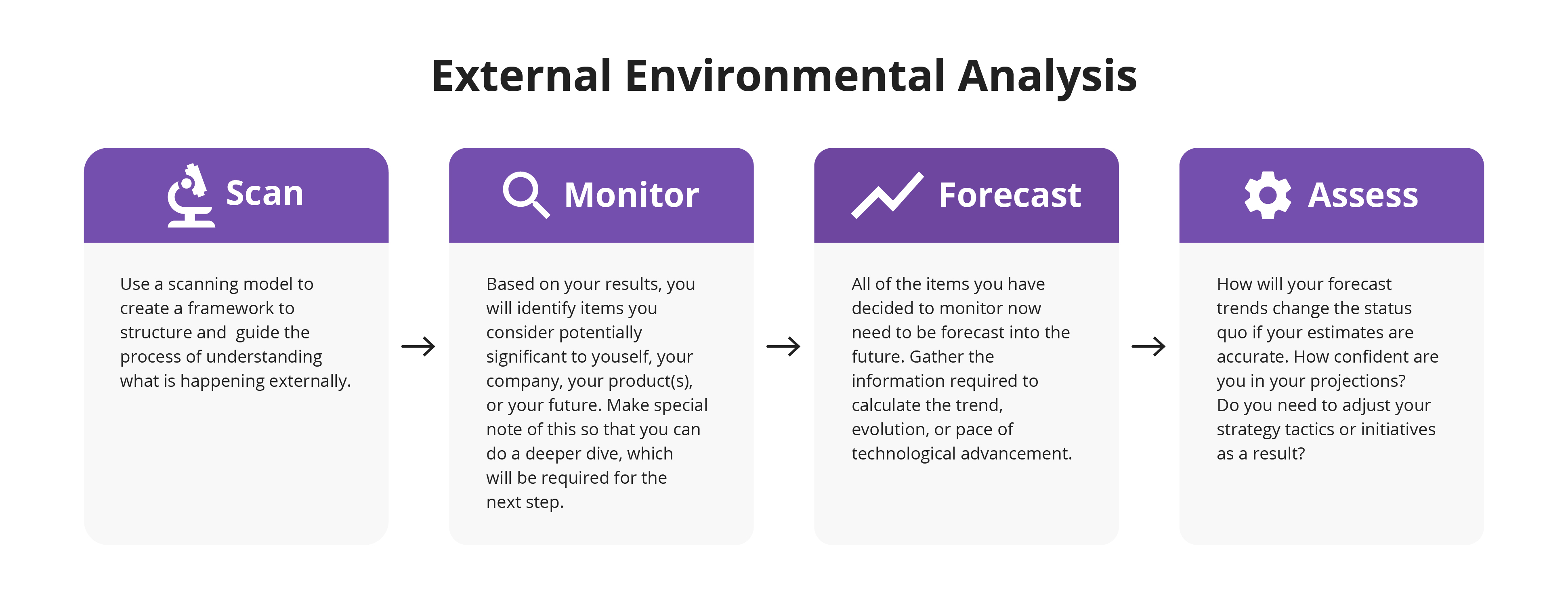

2-3. The Quadrants of External Environmental Analysis

The process consists of:

- Scanning: Detecting early signs of possible changes in the external environment.

- Monitoring: Observing environmental trends to spot evolving patterns.

- Forecasting: Predicting the trajectory of these trends.

- Assessing: Determining the implications of these changes and trends for the firm's strategies.

2-4. The Seven Facets of the General Environment

- Demographic Segment: Population metrics such as size, age, ethnicity, and distribution.

- Economic Segment: The health and direction of the economy.

- Political/Legal Segment: How organizations and governments enact laws and regulations.

- Sociocultural Segment: Societal values, norms, and customs.

- Technological Segment: Innovations and advancements in technology.

- Global Segment: Global trade dynamics and the world economic climate.

- Sustainable Physical Environment Segment: Sustainability issues and the role of businesses in environmental stewardship.

2-5. The Five Pillars of Competitive Forces

These forces, proposed by Michael Porter1, dictate an industry's profitability:

- Threat of New Entrants: How easy it is for new competitors to enter the market.

- Bargaining Power of Buyers: The leverage buyers have in driving down prices.

- Bargaining Power of Suppliers: The leverage suppliers have in driving up input costs.

- Threat of Substitute Products: The potential of other products to replace the demand for the current product.

- Rivalry Among Existing Competitors: The intensity of competition among existing players. Complementors are another force, representing entities or products that enhance the value of the firm's own products.

1The Investopedia Team. (2023 June 19). Porter's 5 Forces Explained and How to Use the Model. Investopedia. https://www.investopedia.com/terms/p/porter.asp

2-6. Strategic Groups Defined

Strategic Groups: Clusters of firms within an industry that have similar business models or strategies. Understanding these groups can help firms identify direct competitors and potential threats or opportunities.

2-7. Competitor Intelligence Gathering

Competitor Analysis: A detailed evaluation of a firm's main competitors. To stay ahead, firms must:

- Understand competitors' strategies, strengths, and weaknesses.

- Use various methods, such as public records, trade shows, and product analysis, to gather intelligence.

- Always adhere to ethical standards when collecting information.

Conclusion

A firm's external environment is a mosaic of factors that can influence its strategic direction. By understanding and adeptly navigating this landscape, firms can position themselves to seize opportunities, mitigate threats, and craft strategies that ensure sustained success.

MEGA Moment

All successful strategy originates from deep understanding and creative insights relating to a company's competitive environment. The global environment for any business is exceptionally complex. It is simply not possible to identify, correlate, and predict all of the factors that will impact your success.

A successful simulation team will be scanning, monitoring, forecasting, and assessing your industry and global external environment before and after each decision. The Environmental Scan and Porter's Five Forces frameworks will be invaluable in helping you to identify factors which will demand your team's attention and proper assessment.

In the first several rounds of the simulation, you will have access to significant but somewhat limited data. By Decision 3 you will have had access to comprehensive market and competitor financial data. The first few rounds will be limited to avoid providing overwhelming data to teams who have limited perspective on what the information might signify.

Key Terms

- General Environment

- Industry Environment

- Competitor Analysis

- Opportunity

- Threat

- Demographic Segment

- Economic Segment

- Political/Legal Segment

- Sociocultural Segment

- Technological Segment

- Global Segment

- Sustainable Physical Environment

- Industry

- Strategic Group

- Complementors

Chapter 3: Understanding the Internal Organization

Introduction

While the external environment is vital, a company's internal resources and capabilities are the engine that drives its success. As you prepare to enter the corporate realm, it is essential to recognize the inner workings of organizations. This chapter will offer insights into how firms leverage their internal strengths to craft winning strategies. By understanding these dynamics, you will be poised to contribute meaningfully to organizational success, whether you are in a startup or a multinational corporation.

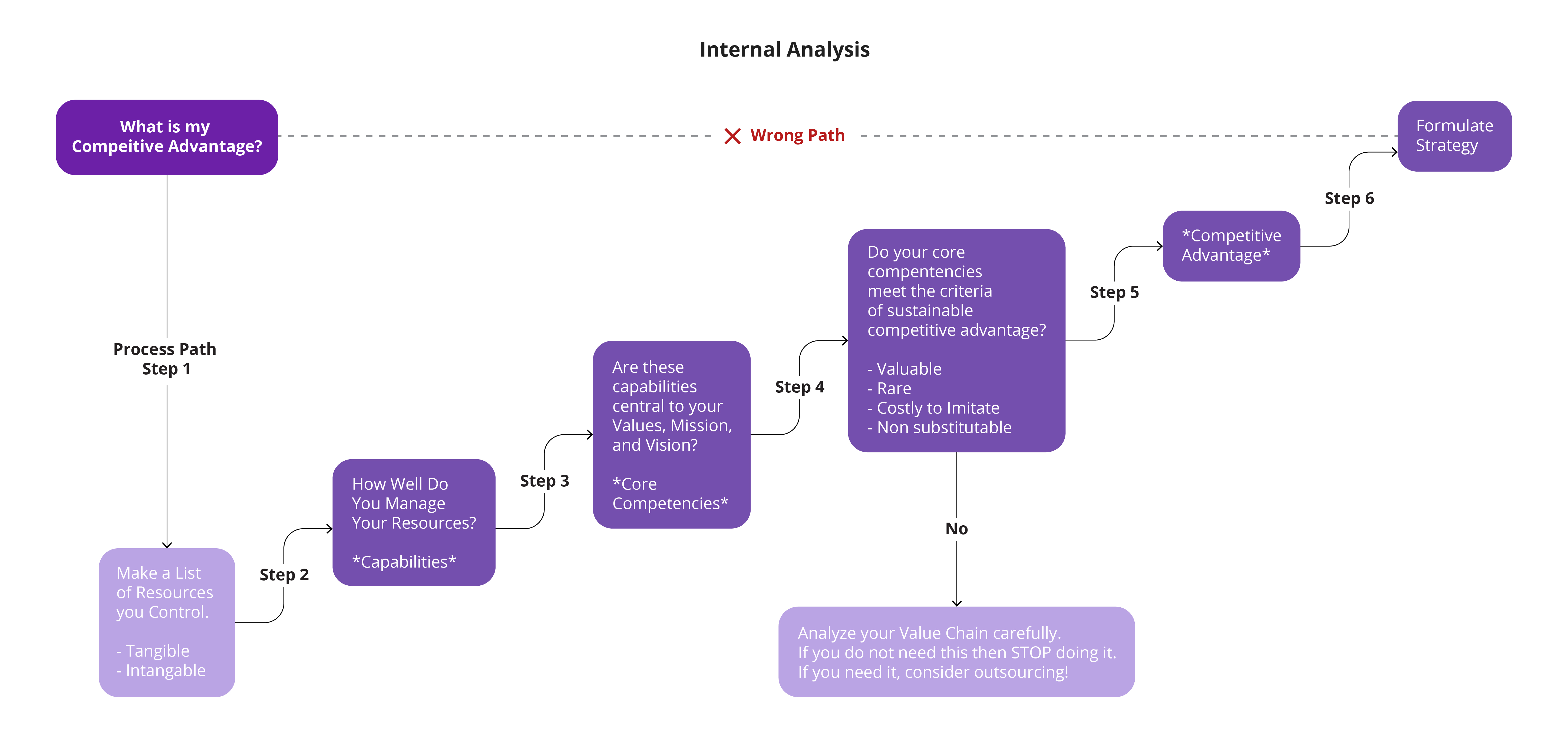

3-1. The Need to Understand the Internal Organization

For a firm to achieve strategic competitiveness and earn above-average returns, it must leverage its internal strengths. Understanding the internal organization helps in identifying resources, capabilities, and core competencies, which are crucial for formulating strategies that can be beneficial in the external environment.

3-2. The Concept of Value

Value: The amount that buyers are willing to pay for what a firm provides them. Value is created when the firm effectively uses its resources, capabilities, and core competencies to satisfy the buyer's needs better than competitors. The importance of value lies in its ability to differentiate a firm's product or service, leading to premium pricing and customer loyalty.

3-3. Tangible vs. Intangible Resources

- Tangible Resources: Physical assets like buildings, machinery, and financial resources. They are typically easier to identify and account for.

- Intangible Resources: Nonphysical assets like brand reputation, company culture, and intellectual property. Though harder to quantify, they can offer more durable competitive advantages.

3-4. Capabilities and Their Development

Capabilities: The firm's capacity to deploy resources purposefully, integrated to achieve a desired end state. They emerge over time through complex interactions among tangible and intangible resources. Development involves continuous investments in learning, upgrading, and adapting to changes.

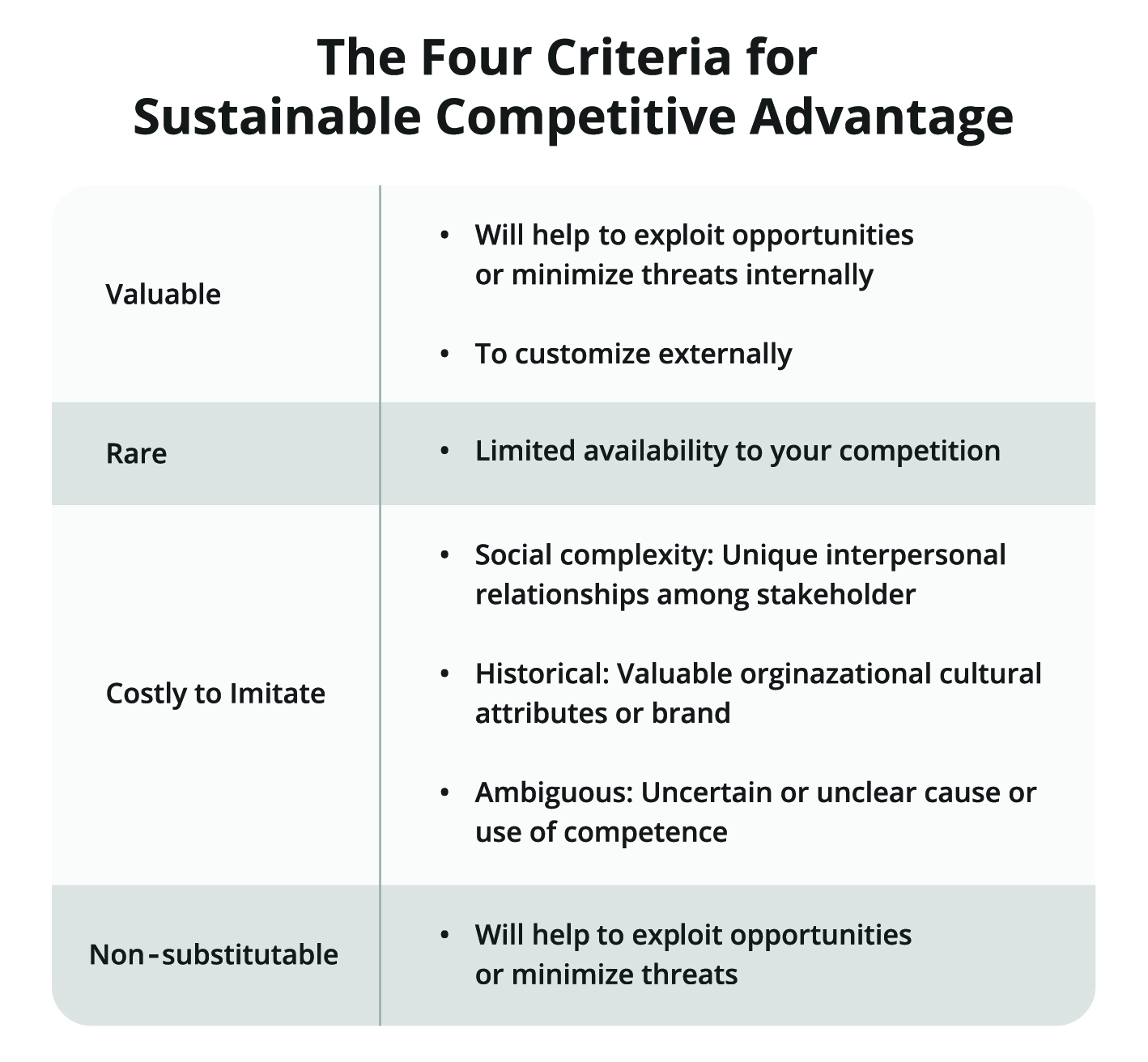

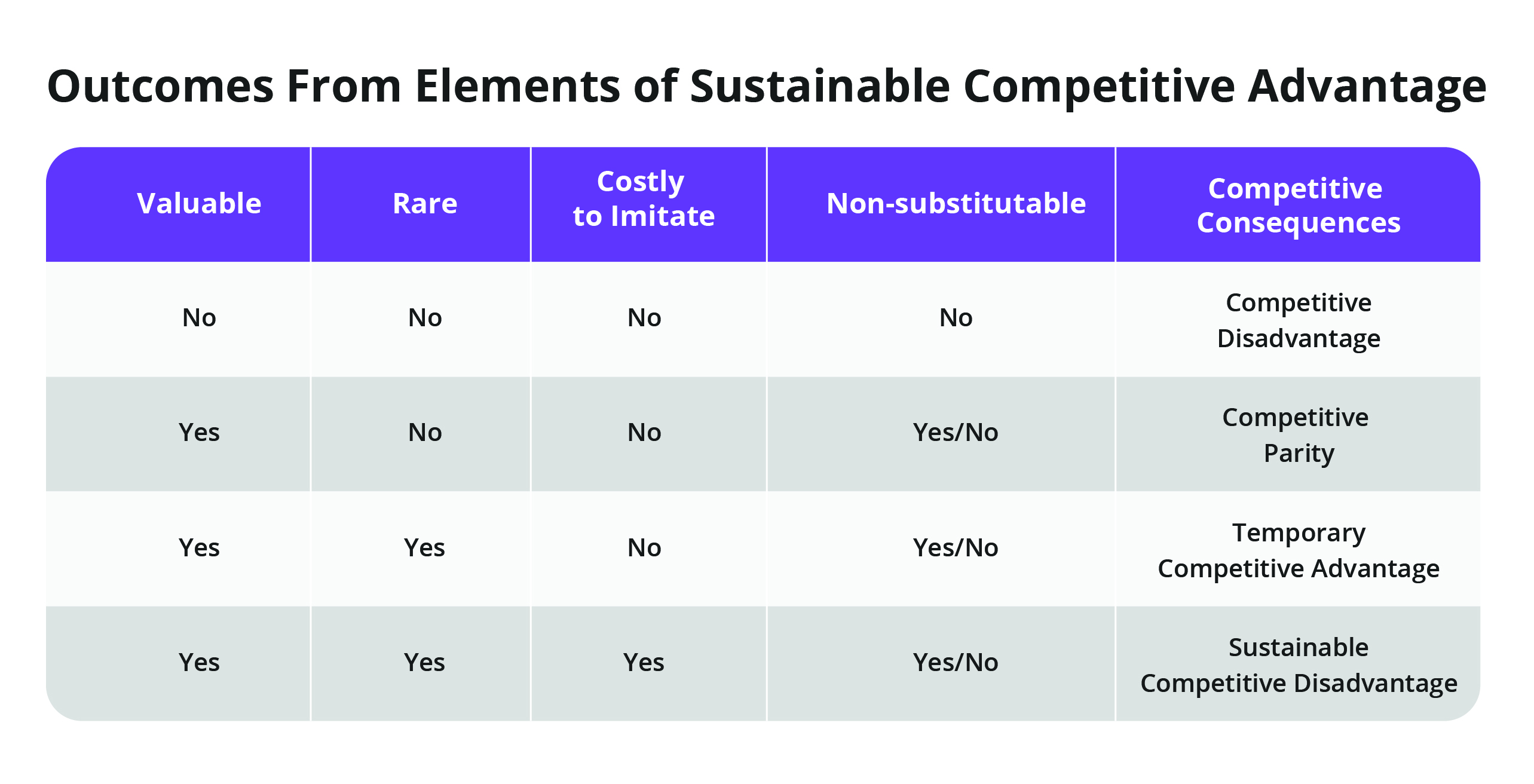

3-5. Criteria for Core Competencies

For resources and capabilities to be considered core competencies, they must be:

- Valuable: Enhance the firm's efficiency or effectiveness.

- Rare: Not possessed by many competitors.

- Costly to Imitate: Difficult for competitors to duplicate.

- Non-substitutable: No strategic equivalents.

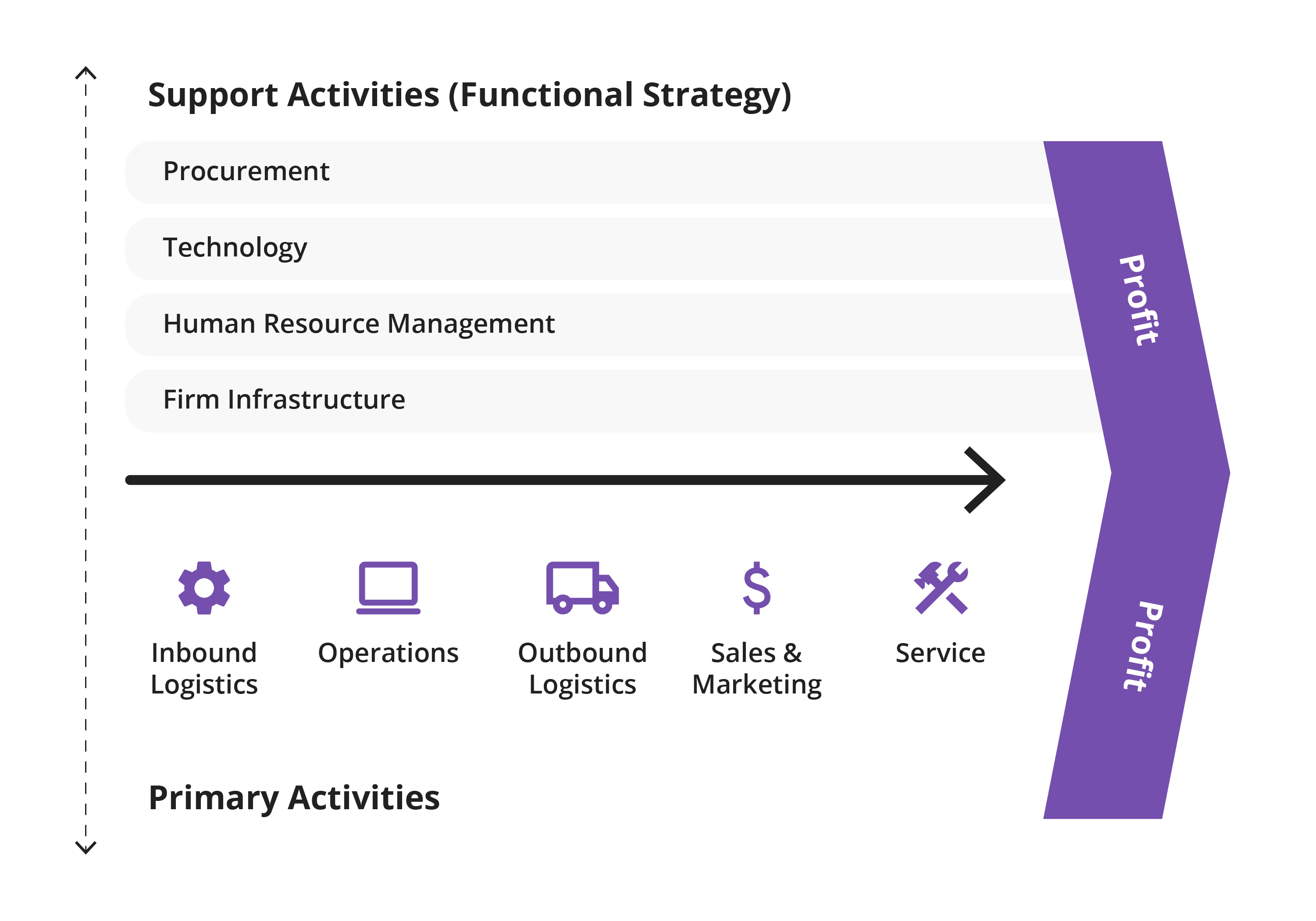

3-6. Analyzing the Value Chain

Value Chain Activities: Discrete steps in the business process where value is added to products or services. Firms analyze these activities to determine where they can best use their resources, capabilities, and core competencies to create maximum value. This includes both primary activities (like production and marketing) and support functions (like human resources and technology development).

3-7. Outsourcing and Its Rationale

Outsourcing: The purchase of a value-creating activity or a support function activity from an external supplier. Firms outsource to:

- Focus on their core competencies.

- Achieve cost savings.

- Access resources not available internally.

- Increase flexibility and responsiveness.

3-8. Identifying Internal Strengths and Weaknesses

A thorough internal analysis helps firms recognize their strengths and weaknesses. Strengths provide a foundation for strategy formulation, while understanding weaknesses allows firms to address them proactively or design strategies that mitigate their impact.

3-9. Avoiding Core Rigidities

Core Rigidities: Former core competencies that now generate inertia and stifle innovation. Firms must avoid core rigidities to ensure that their strengths do not turn into weaknesses in a changing environment. Cultivating a global mindset, which is an ability to analyze, understand, and act upon complex international interdependencies, can help you avoid such rigidities.

3-10. Strategy Tools: The SWOT, TOWS, and PESTLE Assessments

SWOT Assessment: A strategic analytical tool used to evaluate an organization's internal Strengths and Weaknesses as well as its external Opportunities and Threats. The primary purpose of a SWOT analysis is to provide a comprehensive snapshot of a company's strategic position by examining the interplay of internal capabilities and external market conditions.

TOWS Assessment: An advanced strategic tool that builds upon the SWOT analysis to derive actionable strategies by systematically matching a company's internal strengths and weaknesses with its external opportunities and threats. The TOWS assessment ensures that all elements of the SWOT analysis are actively considered in the strategy formulation process, leading to more robust and actionable strategies.

PESTLE Assessment: A macro-environmental analytical framework used to identify and evaluate the external Political, Economic, Social, Technological, Legal, and Environmental factors that might affect an organization. The PESTLE assessment provides a comprehensive understanding of the broader business environment, helping organizations anticipate challenges and opportunities in their strategic planning and decision-making processes.

Comparison of SWOT, TOWS, and PESTLE

- SWOT: Provides a balanced view of internal and external factors, but often lacks depth and can be too static.

- TOWS: Builds upon SWOT to derive actionable strategies but can be more complex and is still largely dependent on the quality of the initial SWOT analysis.

- PESTLE: Exclusively evaluates external macro-environmental factors, offering a comprehensive view of the broader environment, but does not consider internal capabilities or challenges.

Choosing between these tools depends on the specific needs of the analysis. For a quick diagnostic overview, SWOT might suffice. For strategy formulation, TOWS would be more appropriate. And for understanding the broader environment, especially in unfamiliar markets or industries, PESTLE would be the go-to tool. Often, a combination of these tools can provide the most comprehensive insights.

Conclusion

A firm's internal environment is a reservoir of resources, capabilities, and potential competencies. By understanding and optimizing these elements, firms can utilize a variety of strategic tools to identify and craft strategies that not only respond to external challenges but also shape the competitive landscape in their favor.

MEGA Moment

As you formalize your team for the start of the simulation, there is much to consider. You now, or very soon, will have access to the simulation platform, including market and financial information. Remember that all teams have identical financial statements at this point. Each of your competitors begins the simulation in an identical financial and strategic position. Review and apply your learning from Topics 1 and 2, including the hints provided in the noted MEGA Moments.

One of your first steps will be to analyze the information provided to you and to identify the opportunities and threats you find in the data. Given the rules of the simulation and the information provided to all participants, your goal will be to create legitimate strengths relative to your competitors in your pursuit to maximize the opportunities and minimize the identified or projected threats. The proper use of SWOT, TOWS, and PESTLE frameworks will assist you in this respect.

As your student team forms for the first decision, it is recommended that, as a team, you thoroughly and honesty assess your individual strengths and weaknesses. Some degree of specialization among team members is expected but your decisions will require team consensus.

Internally, as it relates to the simulation organization you are building, the team that can properly build and fund an organization that responds to the customer's demands in light of its competitors' market and financial positions, meets the regulatory requirements, and maintains financial viability is key.

In both cases, a realistic, honest assessment of your individual, team, and company strengths and weaknesses will improve your chances of success.

Key Terms

- Costly to Imitate Capabilities

- Global Mindset

- Intangible Resources

- Non-substitutable Capabilities

- Outsourcing

- Rare Capabilities

- Support Functions

- Tangible Resources

- Value

- Valuable Capabilities

- Value Chain Activities

Topic 2 Mini Cases

2.1 Mini Case Study: "The Ride-Hailing Industry - A Deep Dive With Porter's Five Forces"

1. Threat of New Entrants (Entry Barriers)

- Logic: The easier it is for new companies to enter the industry, the more intense the competition.

- Ride-Hailing Analysis: While starting a basic ride-hailing app might not require massive capital, regulatory challenges, network effects, and brand recognition create significant barriers. Thus, the threat of new entrants is moderate.

2. Bargaining Power of Suppliers

- Logic: When few suppliers exist, or when they have significant power, they can dictate terms and prices to businesses.

- Ride-Hailing Analysis: In this industry, suppliers primarily consist of drivers. Since drivers can switch between platforms like Uber and Lyft with relative ease, their bargaining power is relatively high.

3. Bargaining Power of Buyers (Customers)

- Logic: If customers have many options from whom to buy or can easily switch between providers, they can demand lower prices or higher product quality.

- Ride-Hailing Analysis: Customers have a few major apps to choose from (Uber, Lyft, and regional players). The ease of switching between apps gives them considerable power.

4. Threat of Substitute Products or Services

- Logic: If other products or services can fulfill the same need as the industry's product, it can reduce demand.

- Ride-Hailing Analysis: Several substitutes exist for ride-hailing: traditional taxis, public transportation, car rentals, biking, or walking. However, the convenience and price point of ride-hailing apps often make them more attractive.

5. Rivalry Among Existing Competitors

- Logic: If many competitors offer equally attractive products or services, then they will compete on price, which can decrease profitability.

- Ride-Hailing Analysis: The rivalry is intense in the ride-hailing industry. Uber and Lyft, for instance, are in fierce competition in many markets, leading to price wars, aggressive marketing campaigns, and rapid innovation.

Conclusion: Applying Porter's Five Forces to the ride-hailing industry provides a clear picture of the competitive landscape. For a new entrant or an existing player, understanding these forces can guide strategic decisions, from pricing to marketing to expansion. For college students, this model is a lens through which they can dissect any industry, making sense of the underlying dynamics and competitive pressures. In essence, Porter's model offers a roadmap to navigate the complexities of industry competition and to carve out a sustainable niche.

3.1 Mini Case Study: "Starbucks - Brewing Sustainable Competitive Advantage"

Introduction: Sustainable competitive advantage is achieved when a company can maintain its superiority over competitors in the long run. The four criteria to determine this advantage are: value, rarity, inimitability, and non-substitutability. Starbucks, a global coffeehouse chain, offers a compelling case of leveraging these criteria to dominate its competition.

Background: From its humble beginnings in Seattle in 1971, Starbucks has grown to become the world's largest coffeehouse chain. Its iconic green mermaid logo is recognized globally, and the brand has become synonymous with premium coffee and a unique "third-place" experience.

Leveraging the Four Criteria

- Value: Starbucks offers a unique value proposition that goes beyond just coffee. It provides an experience - the "Starbucks Experience." This includes high-quality coffee, a cozy ambiance, free Wi-Fi, and friendly baristas. This experience adds significant value to the customer, differentiating Starbucks from other coffee shops.

- Rarity: While there are numerous coffee shops around the world, Starbucks has managed to create a unique brand identity. Their commitment to ethical sourcing, community involvement, and employee ("partner") welfare sets it apart. Starbucks' loyalty programs and mobile ordering system also offer a distinct experience that is rare in the industry.

- Inimitability: Many have tried to replicate the Starbucks model, but even those who have succeeded are not on the same scale of success. The company's unique blend of quality, ambiance, and customer service is hard to imitate. Its extensive training programs ensure that baristas provide consistent service worldwide. Moreover, Starbucks' relationships with coffee growers, ensuring ethical and quality sourcing, are not easily replicated.

- Non-substitutability: While one can argue that there are many substitutes for Starbucks - local coffee shops, other chains, or even home-brewed coffee – what is non-substitutable is the holistic experience Starbucks offers. The combination of its ambiance, customer service, and community engagement makes it more than just a coffee shop. For many, it is a daily ritual, a workspace, or a place to meet friends.

Strategic Outcomes: Leveraging these criteria, Starbucks has:

- Global Expansion: Starbucks has successfully expanded globally, tailoring its experience to local tastes while maintaining its core brand identity.

- Diversified Offerings: Beyond coffee, Starbucks now offers a range of products, from teas to sandwiches to merchandise, further solidifying its value proposition.

- Digital Engagement: Starbucks has embraced technology, with its mobile app, loyalty program, and mobile ordering system, further enhancing its competitive advantage.

Conclusion: Starbucks' dominance in the coffeehouse industry can be attributed to its ability to leverage the four criteria of sustainable competitive advantage. By offering value that is rare, inimitable, and non-substitutable, Starbucks has brewed a recipe for long-term success, setting a benchmark for competitors and new entrants alike. This case underscores the importance of internal capabilities and resources in carving out a niche and sustaining leadership in a competitive landscape.

3.2 Mini Case Study: "Value Chain Analysis of GreenTech Electronics"

Introduction: Value chain analysis is a strategic tool developed by Michael Porter2 to understand the activities through which a company can create value and competitive advantage. By analyzing each step of the process, from raw materials to the end consumer, companies can identify areas of potential improvement or differentiation. This model can be applied to a fictional electronics company, GreenTech Electronics.

Background: GreenTech Electronics specializes in producing eco-friendly, sustainable electronic products, including smartphones, laptops, and wearables. The company prides itself on using recycled materials and ensuring energy-efficient production processes.

Value Chain Analysis

1. Inbound Logistics:

- Current State: GreenTech sources recycled materials from various suppliers.

- Opportunities: Streamline supply chain management to ensure consistent quality and reduce costs. Form strategic partnerships with suppliers to ensure a steady supply of high-quality recycled materials.

2. Operations:

- Current State: Manufacturing processes are energy-efficient but have longer production times.

- Opportunities: Invest in R&D to develop faster, yet still eco-friendly, manufacturing techniques. Implement lean manufacturing principles to reduce waste and improve efficiency.

3. Outbound Logistics:

- Current State: Distribution is primarily through third-party retailers.

- Opportunities: Develop a direct-to-consumer online sales model, reducing dependency on retailers and improving profit margins. Implement a recycling program where consumers can send back old products for discounts on future purchases.

4. Marketing and Sales:

- Current State: GreenTech's eco-friendly USP is well-received, but brand awareness is moderate.

- Opportunities: Launch targeted marketing campaigns emphasizing the environmental benefits of its products. Collaborate with environmental influencers or organizations to boost brand visibility.

5. Service:

- Current State: Standard warranty and repair services are offered.

- Opportunities: Introduce extended warranties for consumers who recycle or promote eco-friendly initiatives. Offer workshops or webinars on sustainable electronics usage and maintenance.

6. Support Activities:

- Procurement: Strengthen relationships with suppliers, ensuring ethical and sustainable practices.

- Technology Development: Invest in developing proprietary eco-friendly technologies that can set the brand apart.

- Human Resource Management: Train employees on sustainability, ensuring the entire company aligns with its eco-friendly mission.

- Firm Infrastructure: Adopt green energy solutions for company facilities, further emphasizing the brand's commitment to sustainability.

Strategic Positioning Improvements

- Differentiation: By emphasizing its eco-friendly USP and introducing unique offerings like recycling programs or sustainability workshops, GreenTech can further differentiate itself in the crowded electronics market.

- Cost Leadership: Streamlining operations and inbound logistics can help GreenTech reduce production costs, allowing it to offer competitive pricing while maintaining good profit margins.

- Direct Consumer Relationships: By exploring direct-to-consumer sales and fostering a community around sustainability, GreenTech can build stronger brand loyalty and reduce dependency on third-party retailers.

Conclusion: Through a value chain analysis, GreenTech Electronics identified several actionable opportunities to enhance its strategic positioning. By capitalizing on these opportunities, the company can not only improve its operational efficiency but also strengthen its brand identity and consumer relationships in the competitive electronics market. For businesses, a value chain analysis serves as a roadmap to understand how value is added at each stage and where improvements or innovations can be introduced.

2The Investopedia Team. (2023 June 19). Porter's 5 Forces Explained and How to Use the Model. Investopedia. https://www.investopedia.com/terms/p/porter.asp

3.3 Mini Case Study: "SWOT, TOWS, PESTLE Analysis of Tesla, Inc."

SWOT Analysis Strengths

- Innovative Technology: Tesla's proprietary technology, especially in battery and autonomous driving, gives it a competitive edge.

- Brand Recognition: Tesla is synonymous with electric cars, enjoying strong brand equity

Weaknesses

- Production Challenges: Tesla has faced production bottlenecks, especially with the rollout of the Model 3.

- Limited Global Presence: While Tesla is expanding, its presence in emerging markets is still limited.

Opportunities

- Growing EV Market: The global shift towards sustainable energy solutions makes the electric vehicle (EV) market ripe for growth.

- Energy Solutions: Beyond cars, Tesla's energy products, like solar panels and the Powerwall, have significant growth potential.

Threats

- Increasing Competition: Traditional automakers like Ford and GM are entering the EV space with significant resources.

- Regulatory Challenges: Tesla faces regulatory hurdles in various markets, affecting its expansion plans.

TOWS Assessment Strengths-Opportunities (SO) Strategies

- Leverage Innovative Technology for Market Growth: Use its proprietary technology to capture a larger share of the growing EV market.

- Expand Brand Globally: Utilize its strong brand recognition to penetrate emerging markets where the demand for EVs is rising.

Strengths-Threats (ST) Strategies

- Innovative Technology Against Competition: Continuously innovate to stay ahead of traditional automakers entering the EV space.

- Brand Recognition to Navigate Regulatory Challenges: Use its brand's influence to lobby for favorable regulations and form partnerships in challenging markets.

Weaknesses-Opportunities (WO) Strategies

- Address Production Challenges With Market Growth: As the EV market grows, invest in improving manufacturing processes and infrastructure.

- Expand Global Presence Through Partnerships: Form strategic alliances in emerging markets to quickly establish a footprint without significant initial investment.

Weaknesses-Threats (WT) Strategies

- Overcome Production Bottlenecks Before Competition Intensifies: Before the market gets even more crowded, streamline production processes to meet demand efficiently.

- Strengthen Global Strategy Against Regulatory Hurdles: Invest in understanding and navigating regulatory landscapes in different markets to avoid potential setbacks.

PESTLE Assessment Political

- Government Incentives: Many governments offer incentives for purchasing EVs as part of their sustainability and pollution control initiatives.

- Trade Policies: Tariffs and trade wars, especially between the United States and other countries like China, can impact Tesla's international sales and supply chain.

Economic

- Economic Growth: In economies that are growing, consumers might have more disposable income to spend on premium products like Tesla cars.

- Exchange Rates: Fluctuations in currency exchange rates can impact Tesla's profitability.

Social

- Shifting Preferences: There is a growing preference for sustainable and eco-friendly products.

- Urbanization: As urban areas grow, there might be a higher demand for personal vehicles, including electric ones.

Technological

- Battery Technology: Advances in battery technology can either benefit Tesla if they are ahead in R&D or pose a challenge if competitors adopt newer technology faster.

- Autonomous Driving: Tesla is at the forefront of autonomous driving technology.

Legal

- Emission Standards: Stricter emission standards worldwide push automakers to produce cleaner vehicles.

- Safety Regulations: Tesla's autopilot and full self-driving features are under scrutiny.

Environmental

- Climate Change Concerns: As concerns about climate change grow, the shift towards EVs and renewable energy solutions can accelerate.

- Resource Scarcity: Tesla needs lithium for its batteries. Scarcity or geopolitical issues affecting access to such resources can pose challenges.

Conclusion: A PESTLE analysis for Tesla provides a comprehensive view of the macro-environmental factors that the company must navigate. While some elements, like shifting social preferences towards sustainability or government incentives, offer opportunities, others, like trade policies or resource scarcity, pose challenges. For Tesla, understanding these factors is crucial as it charts its global expansion and product development strategies. For students and professionals, PESTLE offers a structured way to assess the broader environment in which a company operates, ensuring that no critical external factor is overlooked in strategic planning.