Topic 1:

Introduction to Strategy and Strategic Management

Chapter 1: Foundations of Strategic Management

Introduction

In today's rapidly changing business world, understanding the foundations of strategic management is crucial for any aspiring business professional. As a college student, you are preparing to enter a competitive landscape where companies constantly vie for an edge. This chapter will introduce you to the core concepts of strategic management, providing you with the tools to think critically about how firms carve out their place in the market. By grasping these foundational elements, you will be better equipped to navigate, contribute to, and lead in the corporate world, ensuring not just survival but success in your future career.

1-1.Core Concepts of Strategic Management

- Strategic Competitiveness: Achieved when a firm formulates and implements strategies that enable it to outperform its competitors by wisely utilizing limited resources.

- Strategy: An integrated and coordinated set of actions taken to exploit core competencies and gain a competitive advantage.

- Competitive Advantage: When a firm creates more economic value than its rivals.

- Above-Average Returns: Returns that exceed what investors expect in comparison to other investments with similar risk.

- Strategic Management Process: A method by which managers conceive of and implement a strategy that can lead to a sustainable competitive advantage.

1-2.The Evolving Competitive Landscape

The competitive landscape is continuously evolving, driven by the global economy and technological changes. The integration of national economies into an interconnected global economy has intensified competition. Additionally, rapid technological advancements have led to hyper competition, where advantages are quickly eroded.

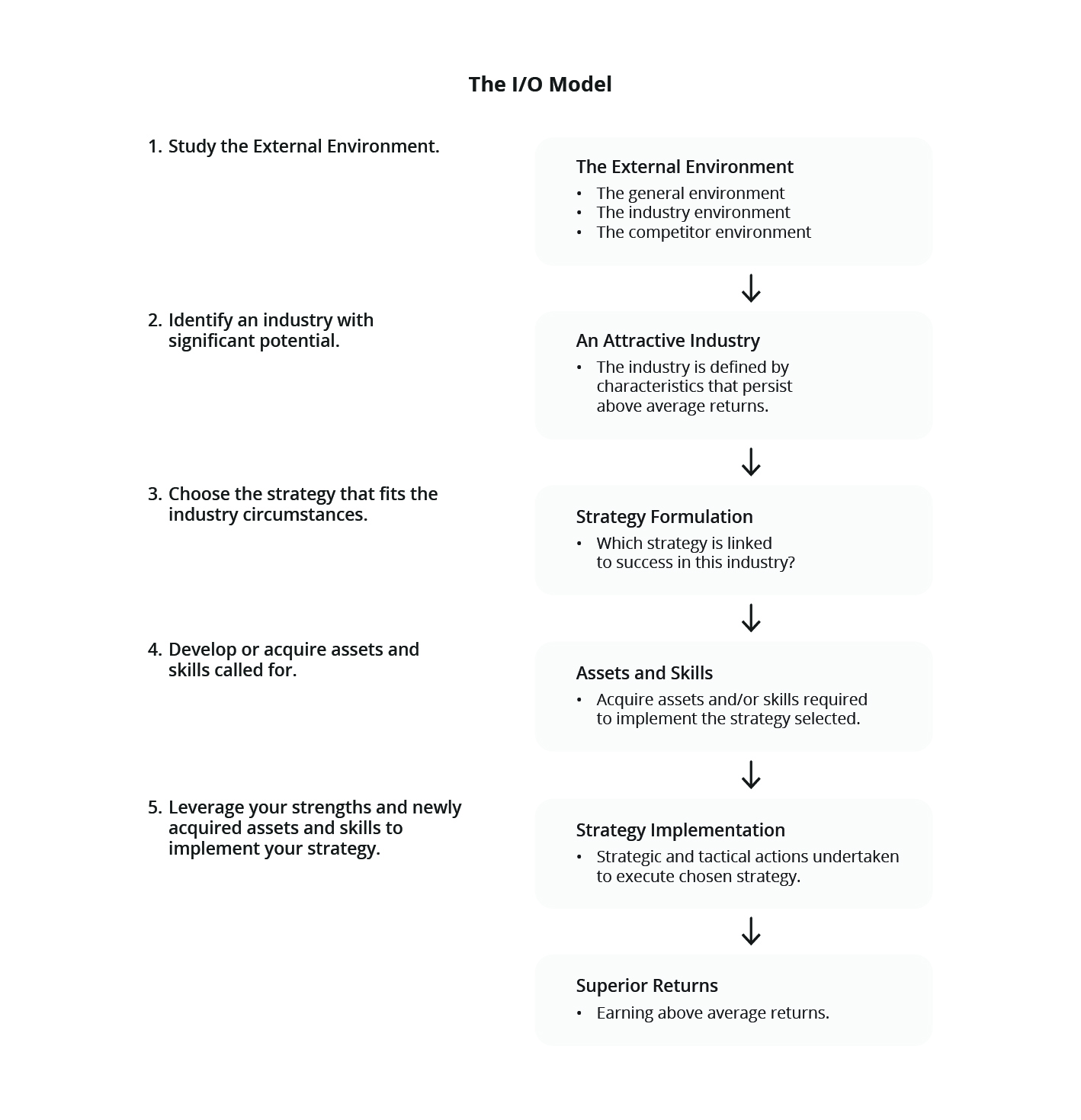

1-3.The I/O Model and Above-Average Returns

The industrial organization (I/O) model posits that the external environment's structure influences a firm's strategic choices. To achieve above-average returns:

- Analyze the external environment.

- Locate an attractive industry.

- Identify the strategy appropriate for the chosen industry.

- Develop assets and skills to implement the strategy.

- Use the firm's strengths to execute the strategy.

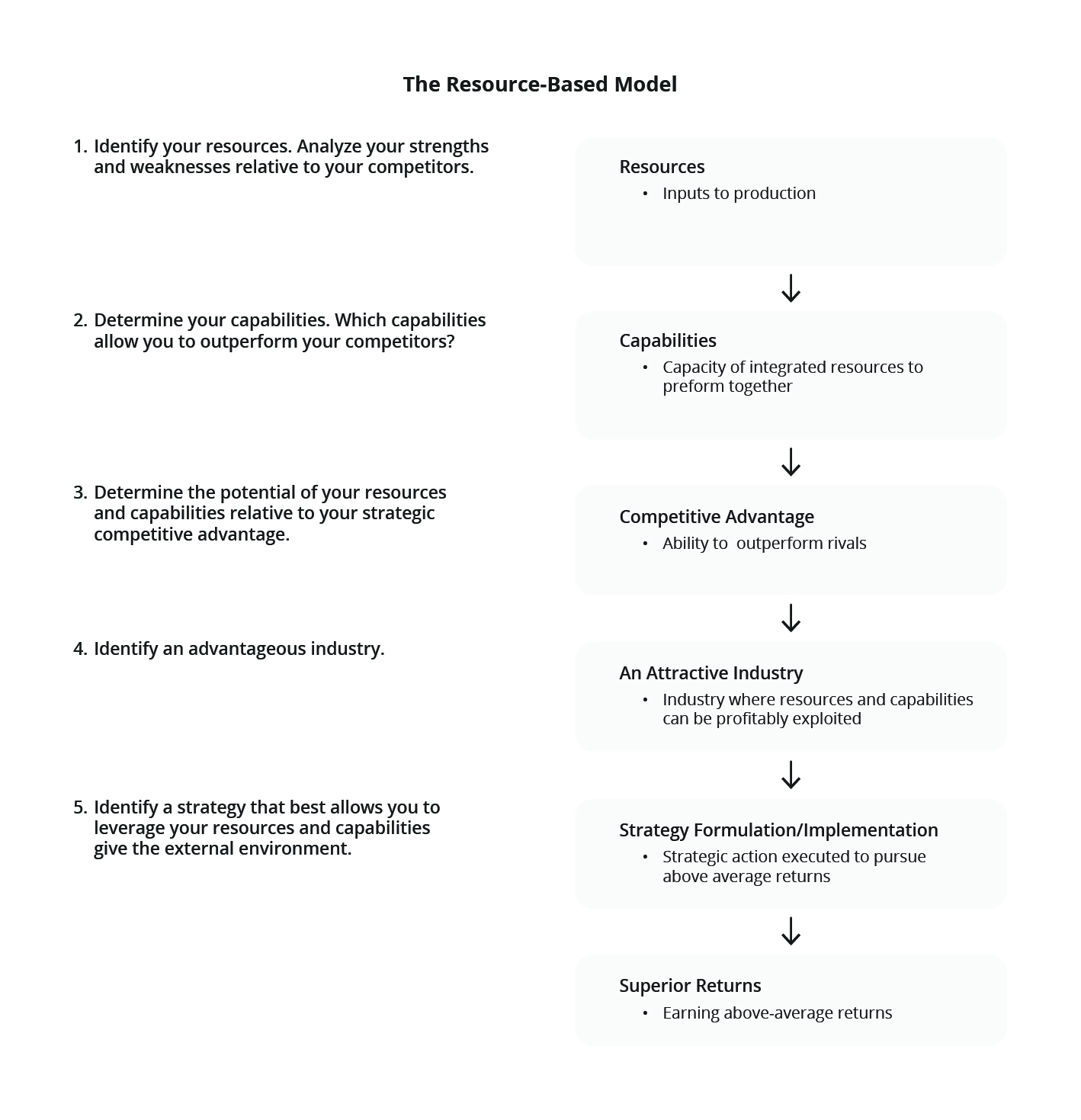

1-4: The Resource-Based Model

This model emphasizes the internal capabilities of the organization in formulating strategy to achieve a competitive advantage in its markets. Firms can earn above-average returns by:

- Identifying their unique resources and capabilities.

- Developing their core competencies.

- Leveraging these competencies to choose and implement strategies.

1-5: The Significance of Vision and Mission

- Vision: Depicts what the organization aspires to be in the future.

- Mission: Describes what the organization does, its purpose, and its reason for existing. Both vision and mission provide direction, unify employees, and communicate the firm's purpose and direction to stakeholders.

1-6: Stakeholders and Their Influence

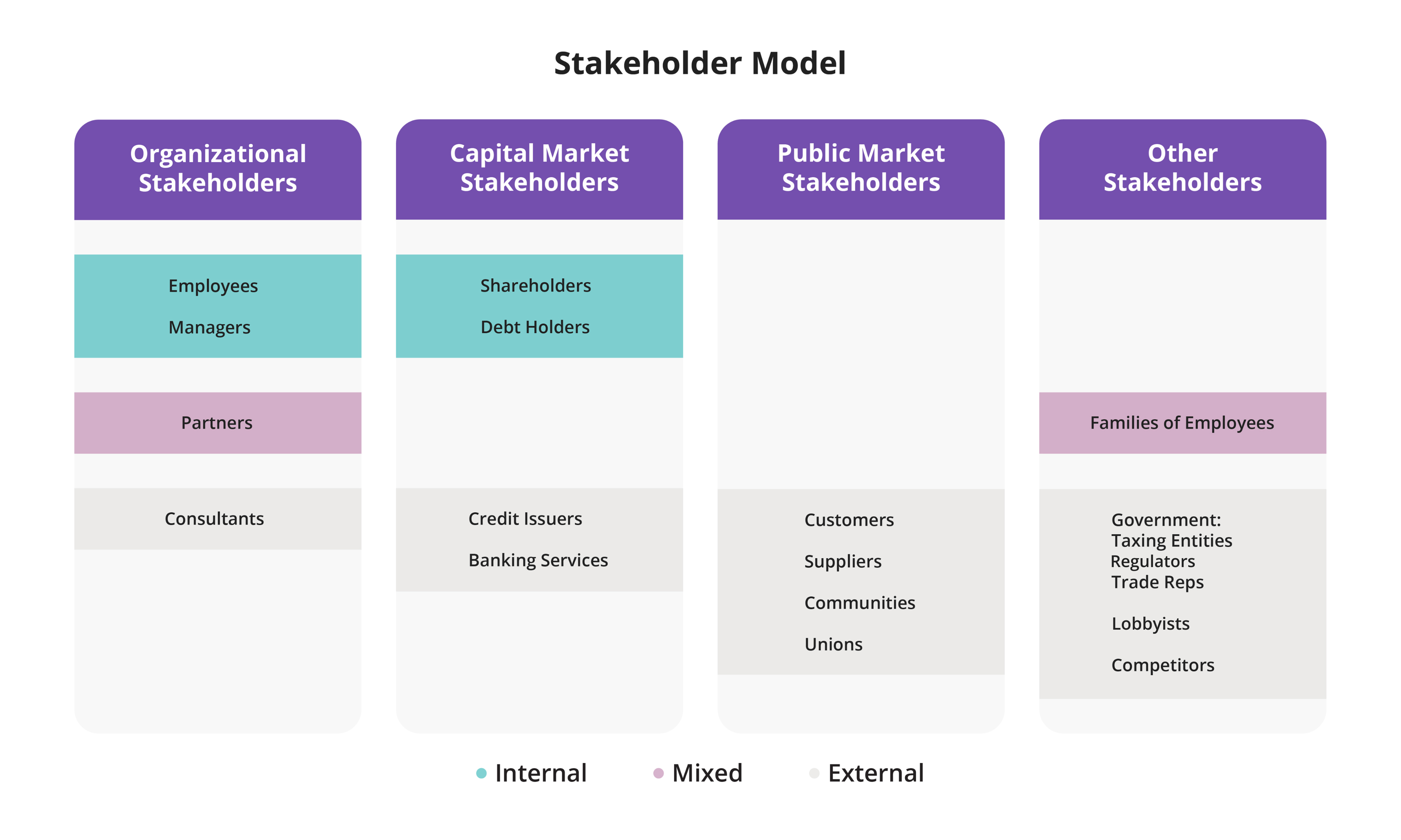

Stakeholders: Individuals, groups, and organizations who have a stake in the success of the organization. They can influence the firm's strategic direction and performance. This influence stems from the resources they control and their broader impact on societal objectives and values.

1.7: Role of Strategic Leaders

Strategic Leaders: Individuals who use the strategic management process to help the firm create value and effectively serve its stakeholders. They envision and execute strategies and ensure that changes in strategy are smoothly implemented.

1.8: The Strategic Management Process

The process involves:

- Defining the firm's vision and mission.

- Analyzing the competitive environment and internal capabilities.

- Formulating a strategy that leverages internal strengths and responds to the external environment.

- Implementing the strategy.

- Monitoring and adjusting the strategy in response to changes in the environment.

1.9: Risk

Risk refers to the uncertainty of an event or action occurring that would have an impact on the achievement of objectives. It encompasses the potential for both positive and negative outcomes. In the context of business, risk can be viewed as the combination of the probability or likelihood of an event occurring and the magnitude of its impact (either beneficial or detrimental) on the organization's objectives.

Positive Risks (Opportunities): These are uncertain events or conditions that, if they occur, have a beneficial impact on a project or business objective. They represent potential gains or opportunities for improvement. For instance:

- Market Expansion: The possibility that a new advertising campaign could resonate exceptionally well, leading to increased market share.

- Technological Advancements: The chance that an investment in research and development could lead to a breakthrough product or service.

- Strategic Alliances: The potential that a partnership or merger could open up new markets or streamline operations more than anticipated.

Negative Risks (Threats): These are uncertain events or conditions that, if they occur, have a detrimental impact on a project or business objective. They represent potential losses or challenges. Examples include:

- Market Fluctuations: The possibility that changes in the market could decrease demand for a product or service.

- Operational Disruptions: Risks such as equipment breakdowns, supply chain interruptions, or labor strikes that can hamper production.

- Regulatory Changes: The potential that new laws or regulations could increase operational costs or limit business activities.

- Reputational Damage: The chance that a product recall or negative publicity could harm the company's brand and customer loyalty. In business, understanding both positive and negative risks is crucial for strategic planning, decision-making, and overall resilience. By identifying, assessing, and managing these risks, organizations can better position themselves to capitalize on opportunities and mitigate potential threats.

Conclusion

Strategic management is pivotal in navigating the complexities of the global economy and the ever-evolving competitive landscape. By understanding its foundational concepts and models, firms can position themselves for sustained success and value creation.

MEGA Moment

Success in the MEGA simulation will be significantly related to your ability to understand the customers you are competing for in various markets and aligning your strategy and resources to deliver the value proposition under conditions of uncertainty and with finite resources.

Many of the risks (uncertainties) noted herein are built into the simulation and will manifest in the results of operations based on the decisions you and your competing teams progressively make. The Student Guide and Customer Value Challenge "cheat sheet," if carefully read, will provide insight relating to these issues.

Outside of the MEGA platform but related to this class, you will also provide corporate mission and vision statements and a brief values definition that define your team. You will endeavor to operate your team internally and in the competition in conformance with these "public facing declarations."

Your goal in the simulation is to be a leader in as many of the winning metrics as possible. In Topic 3, you will be introduced to the simulation, but there are readings available and accessible now should you desire more insight.

Key Terms

• Above-Average Returns

• Average Returns

• Capability

• Competitive Advantage

• Core Competencies

• Global Economy

• Hypercompetition

• Mission

• Organizational Culture

• Profitability / ROI

• Resources

• Risk

• Stakeholders

• Strategic Competitiveness

• Strategic Flexibility

• Strategic Leaders

• Strategic Management Process

• Strategic Thinking

• Strategy

• Vision

• Values

Topic 1 - Mini Cases

1.1 Mini Case Study: "GreenTech Corp. - Navigating Stakeholder Conflicts"

Introduction: Stakeholder analysis is a crucial process for organizations to identify and understand the interests, influence, and potential impact of various stakeholders. In this case study, you will explore how GreenTech Corp., a large for-profit corporation in the renewable energy sector, navigated stakeholder conflicts and made difficult decisions.

Background: GreenTech Corp. had been a pioneer in developing and implementing renewable energy solutions. As a publicly traded company, it had a diverse group of stakeholders, including shareholders, employees, customers, suppliers, regulators, and environmental activists. GreenTech's leadership recognized the importance of balancing the interests of these stakeholders to ensure long-term success.

The Conflict: GreenTech was planning to build a new solar power plant in a region with abundant sunlight. However, the proposed site was near a small town, and the local community had concerns about the plant's impact on its land, water resources, and aesthetics. Environmental activists were also concerned about the potential disruption to local ecosystems. On the other hand, shareholders were excited about the project's potential returns, and employees were looking forward to new job opportunities.

Stakeholder Analysis:

- Identifying Stakeholders: GreenTech identified the key stakeholders involved: shareholders, employees, local community, environmental activists, and regulators.

- Understanding Interests: GreenTech conducted surveys, held town hall meetings, and engaged with stakeholder representatives to understand their concerns and interests.

- Assessing Influence and Impact: GreenTech assessed the influence and potential impact of each stakeholder group. Shareholders had financial influence, employees had operational impact, the local community could influence regulatory approvals, and environmental activists could sway public opinion.

Navigating the Conflict:

- Engaging With Stakeholders: GreenTech's leadership engaged in open dialogues with the local community and environmental activists. They listened to their concerns and provided information about the project's benefits and mitigation measures.

- Balancing Interests: GreenTech decided to modify the project plan to address the concerns. It reduced the plant's size, implemented water conservation measures, and designed the plant to minimize visual impact. GreenTech also committed to preserving local ecosystems and providing community benefits like educational programs and infrastructure improvements.

- Communicating Decisions: GreenTech communicated the revised plan to all stakeholders, explaining the rationale behind the changes and how it balanced the interests of different stakeholder groups.

Conclusion: GreenTech's approach to stakeholder analysis and conflict resolution demonstrates the importance of understanding and balancing stakeholder interests. By engaging with stakeholders, modifying plans, and communicating decisions transparently, GreenTech was able to navigate conflicts and build a solar power plant that benefited multiple stakeholders. This case highlights the challenges and complexities of stakeholder analysis and the need for business leaders to make thoughtful decisions that consider the interests of diverse stakeholder groups.

1.2 Mini Case Study: "The Rise of Streaming Services - An I/O Model Perspective"

Introduction: The industrial organization (I/O) model suggests that a firm's strategy and performance are largely determined by the external environment or industry structure. This model focuses on how industry forces shape competitive behaviors and outcomes.

Background: In the early 2000s, the entertainment industry was dominated by cable television, DVD rentals, and cinema. However, the advent of the internet and technological advancements gave rise to a new industry: online streaming. Companies like Netflix, initially a DVD-by-mail service, began to explore the potential of offering content online for direct streaming.

Industry Forces:

- Threat of New Entrants: Initially, high barriers to entry existed due to the need for licensing agreements with content creators and the technological infrastructure required for streaming. However, as technology became more accessible and more companies recognized the profitability of streaming, the threat of new entrants increased. Amazon Prime, Hulu, and Disney+ are just a few examples.

- Bargaining Power of Suppliers: Content creators, such as movie studios and TV networks, held significant power. They could dictate terms and prices for their content. This led companies like Netflix to start producing original content, reducing their dependency on external suppliers.

- Bargaining Power of Buyers: With multiple streaming platforms available, consumers had a choice. This gave them significant power, pushing streaming services to continuously innovate, improve content offerings, and maintain competitive pricing.

- Threat of Substitute Products: While cable TV and cinemas were the primary substitutes, their appeal diminished as streaming services offered more convenience and affordability. However, other forms of entertainment, like video games or user-generated content platforms like YouTube, remained as substitutes.

- Rivalry Among Existing Competitors: The competition in the streaming industry became fierce. With each service trying to differentiate itself through exclusive content, user experience, and pricing strategies, rivalry was and continues to be intense.

Strategic Response: Given the industry forces, streaming services had to adapt and strategize:

- Original Content: To counteract the bargaining power of suppliers and differentiate from competitors, platforms like Netflix and Amazon Prime started producing their own content.

- Global Expansion: To tap into new markets and reduce dependency on domestic subscribers, streaming services expanded globally.

- Diversification: Some platforms diversified their offerings. For instance, Amazon Prime bundled its streaming service with its e-commerce subscription, providing added value to subscribers.

Conclusion: The rise of streaming services and their subsequent strategies can be effectively understood through the lens of the I/O model. The industry's external forces shaped the competitive landscape, pushing companies to adapt, innovate, and continuously strategize to achieve and maintain a competitive advantage. As students of business strategy, recognizing the interplay of these forces and understanding how firms respond is crucial in any industry analysis.

1.3 Mini Case Study: "Apple's Dominance - A Resource-Based View"

Introduction: The resource-based view (RBV) of a firm emphasizes the internal capabilities of the organization in developing a competitive advantage, in contrast to the I/O model which focuses on external industry factors. According to RBV, it is the firm's unique resources and capabilities that drive its strategy and performance.

Background: Apple Inc., known for its innovative products like the iPhone, iPad, and MacBook, has consistently dominated various segments of the tech industry. While external factors play a role, Apple's success can be largely attributed to its internal resources and capabilities.

Key Resources and Capabilities:

- Innovative Culture: Apple's organizational culture, shaped by visionaries like Steve Jobs, emphasizes innovation, design, and precision. This culture is a unique intangible resource that drives the company's product development.

- Brand Reputation: Apple's brand is one of the most recognized and valuable in the world. This reputation, built over decades, is a significant intangible asset that commands customer loyalty and premium pricing.

- Integrated Hardware-Software Approach: Unlike many competitors, Apple controls both the hardware (like iPhones) and the software (iOS). This capability ensures seamless integration, offering a superior user experience.

- Retail Stores: Apple's global network of retail stores, characterized by their iconic design and strategic locations, not only serve as sales points but also as branding tools, enhancing customer experience and loyalty.

- R&D Capabilities: Apple's commitment to research and development (R&D) allows it to stay at the forefront of technological innovation, ensuring its products are often ahead of the curve.

Strategic Response: Leveraging these resources and capabilities, Apple creates:

- Differentiated Products: Apple's products stand out in design, functionality, and user experience, allowing the company to charge premium prices.

- Ecosystem Creation: Apple has created an interconnected ecosystem where each product complements others, encouraging users to invest in multiple Apple products.

- Continuous Innovation: Through its R&D capabilities, Apple frequently updates its product line, ensuring it remains relevant and ahead of competitors.

Comparison With I/O Model: While the I/O model would focus on the external competitive forces in the tech industry, such as competitor actions, supplier powers, or potential entrants, the RBV focuses on what Apple has internally that makes it stand out. It is not just about the industry's structure but about the unique resources and capabilities Apple possesses. While competitors operate in the same external environment, they do not achieve the same level of success as Apple, underscoring the importance of internal factors.

Conclusion: Apple's dominance in the tech industry, when viewed through the RBV, highlights the importance of a firm's internal resources and capabilities in achieving and sustaining a competitive advantage. While external industry conditions matter, as posited by the I/O model, a company's unique internal strengths can be the driving force behind its success. Understanding both these models provides a holistic view of strategy formulation and competitive dynamics.

1.4 Mini Case Study: "AquaBrew Co. - Capitalizing on the Craft Seltzer Wave"

Introduction: In the ever-evolving beverage industry, staying ahead of consumer trends is crucial. AquaBrew Co., a mid-sized brewery known for its craft beers, identified a positive risk in the rising popularity of craft seltzers. This case study explores how AquaBrew strategized to capitalize on this trend while safeguarding against potential pitfalls.

Background: AquaBrew Co. had built a reputation for its innovative and high-quality craft beers. However, with market research and industry insights, their strategy team identified a growing trend: the rise of craft seltzers. These beverages, known for being low-calorie and flavorful, were gaining traction, especially among health-conscious millennials.

The Opportunity (Positive Risk): Craft seltzers represented a significant market opportunity. If AquaBrew could produce a successful line, it could tap into a new customer segment and boost revenues. However, this venture was not without risks. The seltzer market was new, and AquaBrew had no experience in it. There was also the chance that the trend could fizzle out, leaving AquaBrew with unsold inventory and wasted investment.

Strategic Execution:

- Product Development: AquaBrew decided to leverage its expertise in flavor creation from its beer production. It developed a range of unique seltzer flavors, ensuring they stood out in the market.

- Pilot Launch: Instead of a full-scale launch, AquaBrew introduced its seltzers in select locations. This allowed them to gauge consumer response without overcommitting resources.

- Marketing Synergy: AquaBrew marketed the seltzers alongside their craft beers, leveraging the established brand reputation. Collaborations with fitness influencers also helped in promoting the low-calorie aspect of the seltzers.

Minimizing Impact of Unfavorable Outcomes:

- Flexible Production: AquaBrew utilized flexible production schedules. This meant it could quickly ramp up seltzer production if demand was high or scale down if the response was lukewarm.

- Diversified Suppliers: AquaBrew sourced ingredients from multiple suppliers with short-term contracts, ensuring it was not locked into long-term commitments.

- Feedback Loops: AquaBrew established feedback mechanisms at pilot locations to understand consumer preferences and make real-time adjustments to flavors or marketing strategies.

Conclusion: AquaBrew's foray into craft seltzers showcases how companies can identify and capitalize on positive risks. The company's strategic approach, combined with safeguards against potential downsides, ensured it was poised to reap the benefits of the seltzer trend while minimizing the impact of unfavorable outcomes. This case serves as a testament to the importance of agile strategy and risk management in seizing market opportunities.